Four state-owned commercial banks had to reschedule loans to the tune of Tk3,700 crore in the first nine months of last year, mainly due to pre-election regularisation of loans taken by the politically influential people – many of them taking part in the general election being held today.

It was almost three times than the amount of Tk1,326 crore rescheduled in the whole year of 2012 thanks to candidates rescheduled their default loans, according to Bangladesh Bank data.

Bankers, however, see the facility as a temporary solution to show cleaner balance sheet while paving the way for defaulters to take part in the election through paying only a marginal amount against big overdue loans.

Maximum of the big default loans of the banks were taken mostly by the politicians, said a senior executive of a state-owned bank.

Before any election, it’s a regular practice intended candidates want to regularise their default loans through rescheduling.

The banks are suffering from provision shortfall, capital deficit and huge non-performing loans due to severe credit scams in last few years, said a senior Bangladesh Bank executive told the Dhaka Tribune, requesting anonymity.

To recover the financial health of the banks, International Monetary Fund (IMF) put pressure to reduce the NPL.

But, he said, the banks rescheduled the classified loans as an alternative means instead of recovering loans.

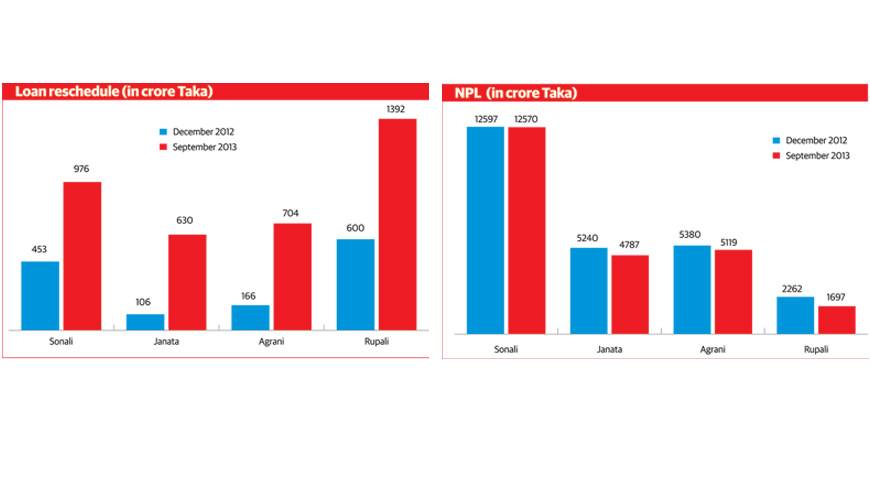

According to the central bank, Sonali Bank rescheduled loans of Tk976 crore during the period of January to September last year – 115% higher from Tk453 crore in December 2012.

In case of Janata Bank, it increased by 500% to Tk630.62 crore in September last year from Tk106 crore in December 2012. For Agrani Bank, the amount stood at Tk704 crore with an increase of 322% from Tk166.47 crore.

Rupali Bank rescheduled the loans of Tk1392 crore, which was 131% higher from Tk600.57 crore in December 2012.

The reschedule, however, helped slightly mitigate the burden of classified loans during the period.

According to Bangladesh Bank data, total classified loan of Sonali Bank stood at Tk12,570 crore in September down from Tk12,597.5 crore in December 2012 while Janata Bank’s default loan stood at Tk4,787 crore from Tk5,240 crore, Agrani Bank at Tk5,119 crore from Tk5,380 crore and Rupali Bank Tk1,697 crore from Tk2,262 crore.

Agrani Bank Managing Director Sayed Abdul Hamid said many candidates have a tendency to reschedule loans in the election year, which was one of the major causes of increasing loan rescheduling.

He said Bangladesh Bank also provided opportunities for the banks to reschedule loans by paying lower down payment than required.

However, he said, the loan rescheduling would help improve the banks’ financial health though temporarily. But it is less harmful for the banks than what they are facing due to the political unrest.

“The classified loans of the banks however reduced due to the rescheduling. But it is an accounting concept, not theoretical,” said former Bangladesh Bank Governor Dr Salehuddin Ahmed.

It would facilitate the banks to show on paper lower level of NPL so they would need to keep less provision than required, he said. It is not expected as well.

“Banks could provide loan rescheduling facility to the really affected businessman by considering case to case basis. But the facility for all will be incentive for corrupt people in the banking sector. But it would make life a hell for those want to work in a level-playing field,” he said.

Dr Ahmed said it is not a rational decision to recapitalise the state-owned banks, which are full of corruption, from the public money.

“The contamination of the financial sector is spreading through other sectors and harming the overall economy as we can see already.”

According to the Bangladesh Bank data, Sonali Bank registered a negative credit growth by 13% in September last year, followed by Janata Bank negative 8.50% and Agrani Bank negative 3.90%. Rupali Bank, however, recorded positive credit growth by14.31%.

Capital shortfall of Sonali Bank stood at Tk4,639 crore against required provision of Tk3,645.49 crore in September last year from Tk3,875 crore in December 2012.

The capital shortfall of Janata Bank stood at Tk1,574 crore from Tk2,011 crore, Agrani Bank Tk2,481 crore from Tk3,414 crore and Rupali Bank’s shortfall stood at Tk170 crore in September.

Source: Dhaka Tribune