Around 60 percent of the target set for savings bonds sales for making up the budget deficit this financial year has already been sold in three months.

A steady decrease in the bank interest rates meant people were more inclined towards investing in the bonds, an economist has said.

“As a result, saving bonds sale has increased abnormally … adding to the government’s burden of loan and interest. This is also tipping its revenue budget,” said Zaid Bakht, research director at Bangladesh Institute of Development Studies.

“We have to get out of this no matter what to revert from putting the budget management at risk.”

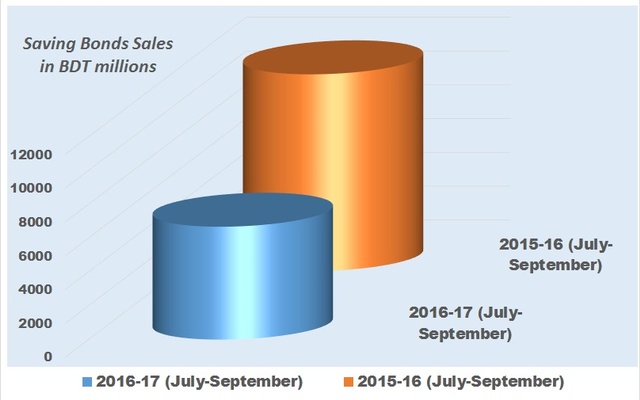

Saving Bonds Sales: July-Sept, 2016-17

# A total 15,113 bonds sold.

# Bonds worth Tk 34.63 billion in interest and capital sold so far.

# Net sales at Tk 116.5 billion.

# The above sum is 60 percent of the target set in budget.

# Govt looks to ‘borrow’ Tk 196.1 billion from savings bond in the fiscal 2016-17.

Info: Department of National Savings

Net sales is the amount that remains after the payment of interests and actual worth of the bonds. The money is saved at the treasury and used for enacting state works. The owner of the bonds must pay interests per month which is why the net sales of savings bonds are considered government ‘borrowings’.

Data from last year’s July to September period shows almost a doubling of the net sales of these bonds. The figure of net bonds sold was at Tk 66.81 billion during the first half of the 2015-16 fiscal.

“People have been leaning towards these schemes because of the decrease in bank interest rates. The interest rates are comparatively higher so people have been using their savings to buy these bonds,” said Bakht.

A slump in investment has caused huge sums of money to lie idle in banks, he said. The banks have been lowering interests due to this ‘idle capital.’

Commercial banks are offering 6.7 percent interest against fixed capital which is a lot lower than what is offered by savings bonds.

Interest rates were still at 11 to 12 percent even after the figure for all kinds of bonds were decreased by two percent in May, 2015.

Zaid Bakht believed there was only one way to avoid the risk posed in budget management due to accumulating loan over the bonds.

“Interest rates must be lowered. The rates must come down in the case of all saving bonds except ‘family bonds’ by women and those by retired government officials for their pensions.”

Source: bdnews24